Adjustment of PhilHealth Contribution Differential 2022

PhilHealth Contribution 2022

In accordance with PhilHealth Advisory No. 2022-0010, and as

prescribed in Section 10 of RA No. 11223 or the Universal Health Care Act, the

new premium rate of 4% for an income floor of P10,000.00 and ceiling of

P80,000.00 shall take effect on January 2022.

From January 2022 to May 2022, the premium rate applicable was 3.00% of the basic salary, the differential of the contribution from January 2022 to May 2022 shall be settled until December 2022.

How do we compute for the PhilHealth Contribution Differential?

1. Get the total PHIC contribution of the employee for every month starting January 2022 to May 2022;

2. Multiply the basic salary of the employee (Jan-May 2022) to the new premium rate which is 4% (0.04);

3. After getting the January 2022 - May 2022 PHIC contributions based on both the old and new premium rate, subtract the old contribution from the new contribution to get the contribution differential.

4. Get the total contribution differential from January 2022 to May 2022;

5. After you have computed the total contribution differential, divide the amount by two (2) to get the Total Differential Employee Share and the Total Differential Employer Share.

Instead of considering the differential as a regular deduction, we can now add them as an Adjustment as they have an impact on the employees' :

1. Gross Income;

2. Total Contributions;

3. Taxable Income;

4. Withholding Tax, and;

5. Net Pay.

Employers have 2 options in deducting/returning the amount to be settled/refunded to the employee in 2 ways:

1. One-Time Deduction/Refund added as Adjustment via Regular Payroll;

2. Periodic Deduction/Refund added as Adjustment via Regular Payroll.

The PHIC contribution differential to be added as an adjustment can be both +/- values. The adjustment should be a positive (+) value if the differential is a liability, and if it is a refund to the employee, it should be a negative (-) value. The differential consists of both the EE and ER shares. Thus, the total contribution differential should still be divided by two.

The PHIC contribution differential to be added as an adjustment can be both +/- values. The adjustment should be a positive (+) value if the differential is a liability, and if it is a refund to the employee, it should be a negative (-) value. The differential consists of both the EE and ER shares. Thus, the total contribution differential should still be divided by two.Adding One-Time Differential as Adjustment

1. The contribution differential should be computed manually;

2. The amount should be divided by 2 as the first half will be considered as the EE share and the second half will be the ER share.

a. Assuming that the total differential is P1000.00, P500.00 will be considered as the EE share and the other P500.00 is the ER share.

3. Go to Employee Records Management > Adjustments.

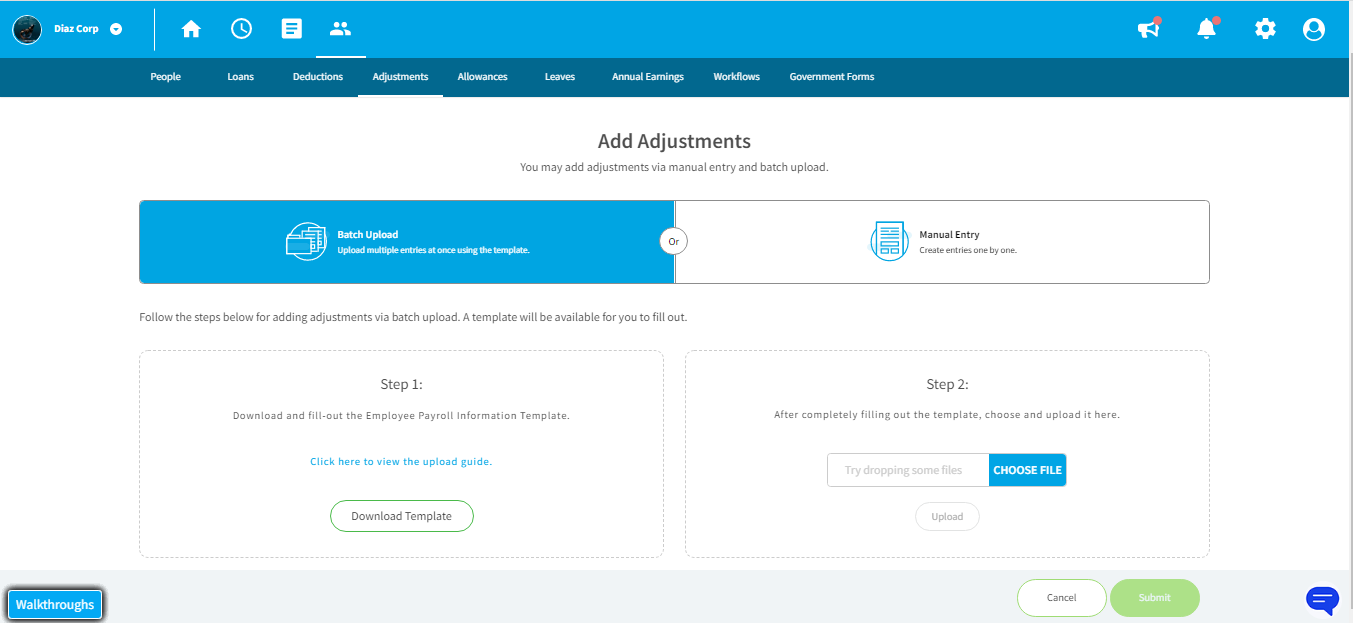

4. Click on Add Adjustments;

5.a. Add Adjustments via Manual Entry. Enter the following details:

- Name of the employee;

- Adjustment type (Philhealth Employee Contribution/Philhealth Employer Contribution)

- Amount (Total Amount of EE differential)

- Payroll Date (any date within the payroll period of the payout date the amount should be deducted/refunded to the employee's salary)

- Reason

EXAMPLE: The total EE differential is 500 pesos. It will be deducted from the employee's pay on June 15, 2022. The payroll period is May 26, 2022 - June 10, 2022.

5.b. Add Adjustments via Batch Upload. Download the template > Accomplish the template > Upload the file.

Sample CSV file

- Employee ID

- Last Name

- First Name

- Middle Name

- Adjustment Type (Philhealth Employee Contribution/Philhealth Employer Contribution)

- Payroll Date (any date within the payroll period of the payout date the amount should be deducted/refunded to the employee's salary. Format: mm/dd/yyyy)

- Include to Special Pay Run? (No)

- Reason

6. Click on Submit.

7. Repeat the process for the Philhealth Employer Contribution.

The Philhealth Employee Contribution should come hand-in-hand with the Philhealth Employer Contribution.

Presentation on the Payroll Details

Presentation on the Payroll Register

Presentation on the Payslips

Adding Periodic Differential as Adjustments

1. The contribution differential should be computed manually;

2. The total differential should be divided by the number of months the differential will be settled.

a. Assuming that the total differential is P1000.00 and will be settled from June 2022 to December 2022 (7 months).

b. P1,000.00 / 7 months = P142.86/month

c. The monthly amount to be settled should then be divided by 2 as the first half will be allocated as EE share and the other half is for the ER share.

d. EE Share / Month = 71.43 | ER Share / Month = 71.43

3. Go to Employee Records Management > Adjustments.

4. Click on Add Adjustments;

5.a. Add Adjustments via Manual Entry. Enter the following details:

- Name of the employee;

- Adjustment type (Philhealth Employee Contribution/Philhealth Employer Contribution)

- Amount (Amount of EE differential for the month)

- Payroll Date (any date within the payroll period of the payout date the amount should be deducted/refunded to the employee's salary)

- Reason

EXAMPLE: The EE differential per month is 71.43. It will be deducted from the employee's pay on June 15, 2022. The payroll period is May 26, 2022 - June 10, 2022.

NOTE: You must repeat the process until you have completed adding the adjustments until the December 2022 payout.

5.b. Add Adjustments via Batch Upload. Download the Template > Accomplish the Template > Upload the file.

Sample CSV file

- Employee ID

- Last Name

- First Name

- Middle Name

- Adjustment Type (Philhealth Employee Contribution/Philhealth Employer Contribution)

- Payroll Date (any date within the payroll period of the payout date the amount should be deducted/refunded to the employee's salary. Format: mm/dd/yyyy)

- Include to Special Pay Run? (No)

- Reason

When accomplishing the CSV file, you may already include all the items to be added from June 2022 to December 2022.

6. Click on Submit.

7. Repeat the process for the Philhealth Employer Contribution.

The Philhealth Employee Contribution should come hand-in-hand with the Philhealth Employer Contribution.

Presentation on the Payroll Details

Presentation on the Payroll Register

Presentation on the Payslips

In adding periodic adjustments, you have the option to deduct/refund the differential in different terms (e.g. 3 months, 5 months, etc).

Related Articles

Update Employee Contribution Basis

Employee Contribution Basis can be updated via the employee profile. To update the contribution basis via the employee profile, 1. From the Admin Dashboard, go to Employee Records Module > People Tab. 2. Find the name of the employee through the ...Employee Government Contribution Basis

Under the Philippine Labor Code, employers are required to remit monthly contributions to government bodies (SSS, PhilHealth, and PAGIBIG Fund) on behalf of their employees, to ensure the employees' access to mandated benefits from the government, ...Adjustment Types

An adjustment is an amount that affects an employee's take home pay. This amount may either be added or deducted from the employee. Adjustments may be applied to the employee’s regular payroll run or through special pay run. Adjustment Types There ...Add Annual Earnings

Annual Earnings or also known as Year-To-Date (YTD) Earnings refers to the amount an employee has been paid so far for the current year. Earnings include all taxable, non-taxable, non-income, and other forms of income. In case of two employers in a ...View and Edit Adjustments

View Adjustments To View Adjustments: 1. From the Top Navigation Bar, head to Employees > Adjustments. Adjustment List is displayed. From this list, you can already view each employee’s adjustment record details: Employee Name Employee ID Reason Type ...