Add Deduction

Add Deductions (Manual Entry)

To Add a Deduction via Manual Entry:

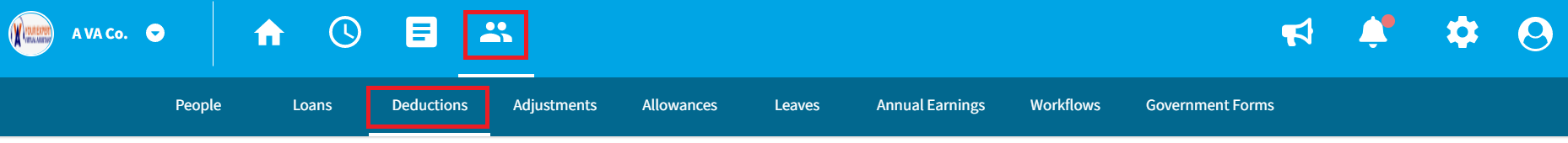

1. From the Top Navigation Bar, click Employees > Deductions.

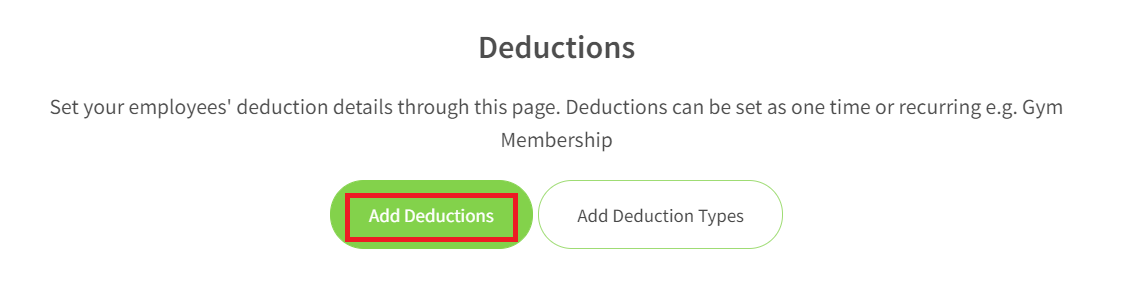

2. Click on the Add Deductions button.

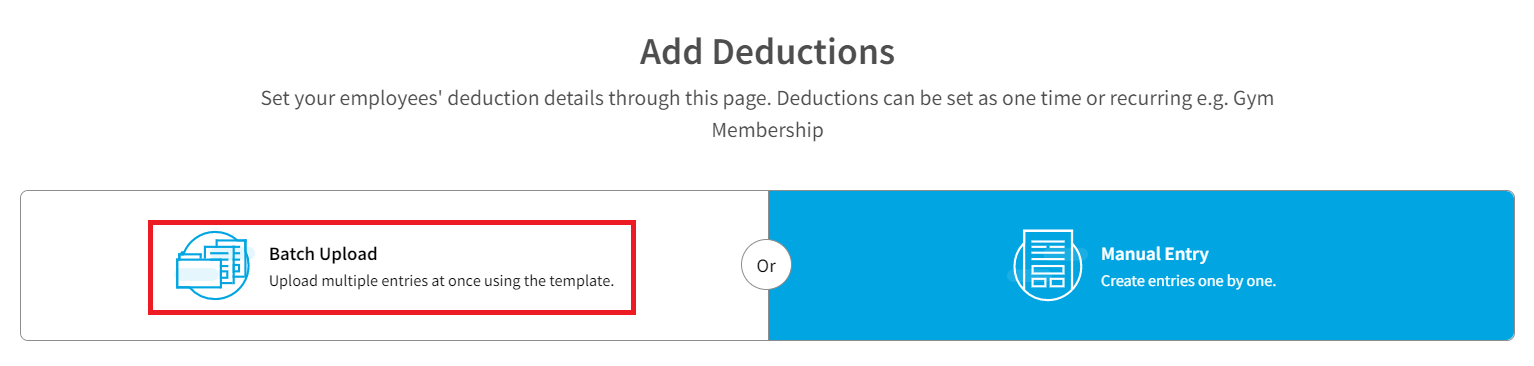

3. Choose the Manual Entry option.

4. Enter the necessary initial information:

- Employee name or Employee ID

- Deduction Type

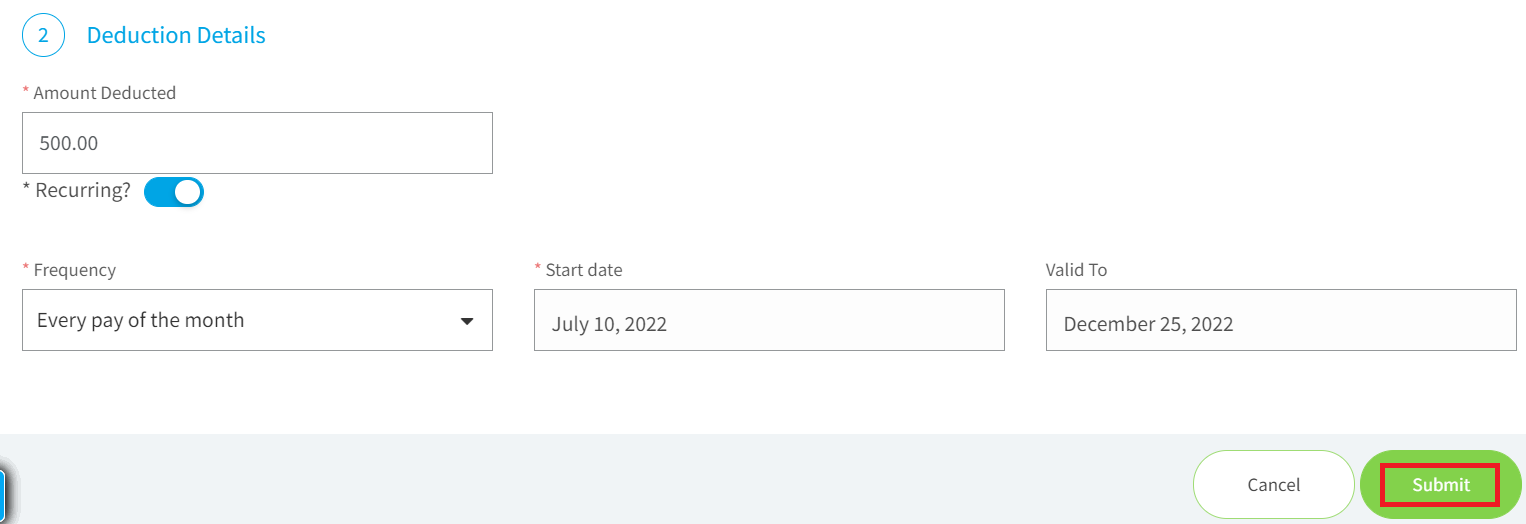

5. In the Deduction Details section, enter the relevant information.

|

Amount Deducted |

|

|

Recurring? |

|

|

Frequency |

· First Pay of the Month: Full amount will be deducted every first pay on a semi-monthly payroll run (e.g. every 15th of the month) · Last Pay of the Month: Full amount will be deducted every last pay on a semi-monthly payroll run (e.g. every 30th of the month) · Every Pay of the Month: Full amount will be divided into the number of payruns in a month and to be deducted every pay |

6. Click on Submit once done.

- The deduction record is saved and is displayed in the Deductions list.

Add Deductions (Batch Upload)

To Add a Deduction (Batch Upload):

1. From the Top Navigation Bar, click Employees > Deductions.

2. Click on the Add Deductions button.

3. Choose the Batch Upload option.

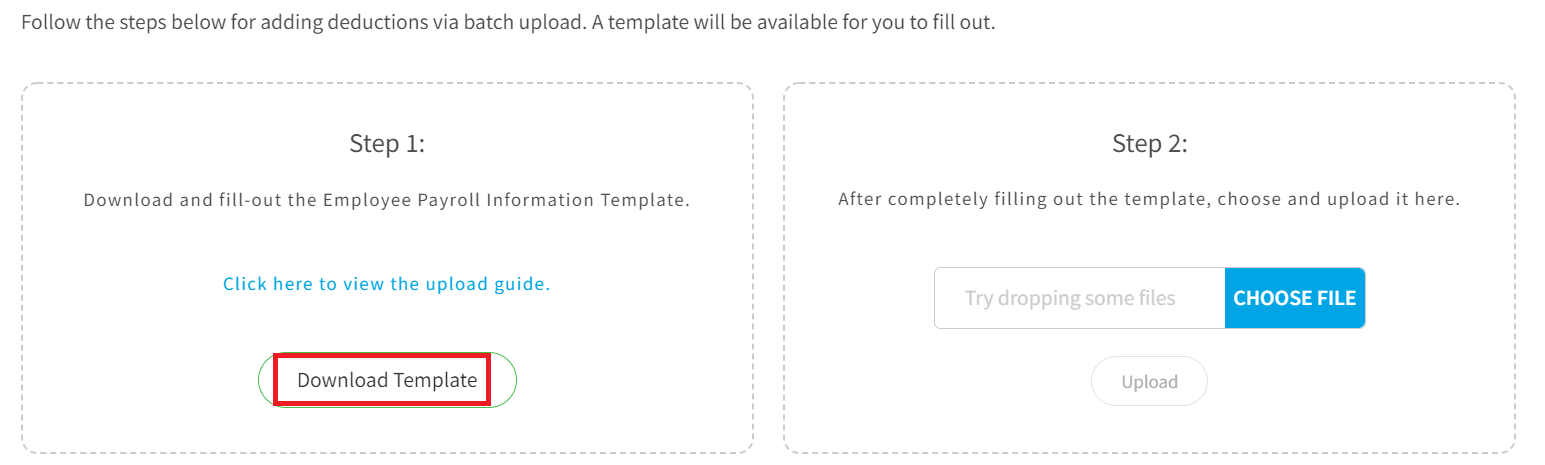

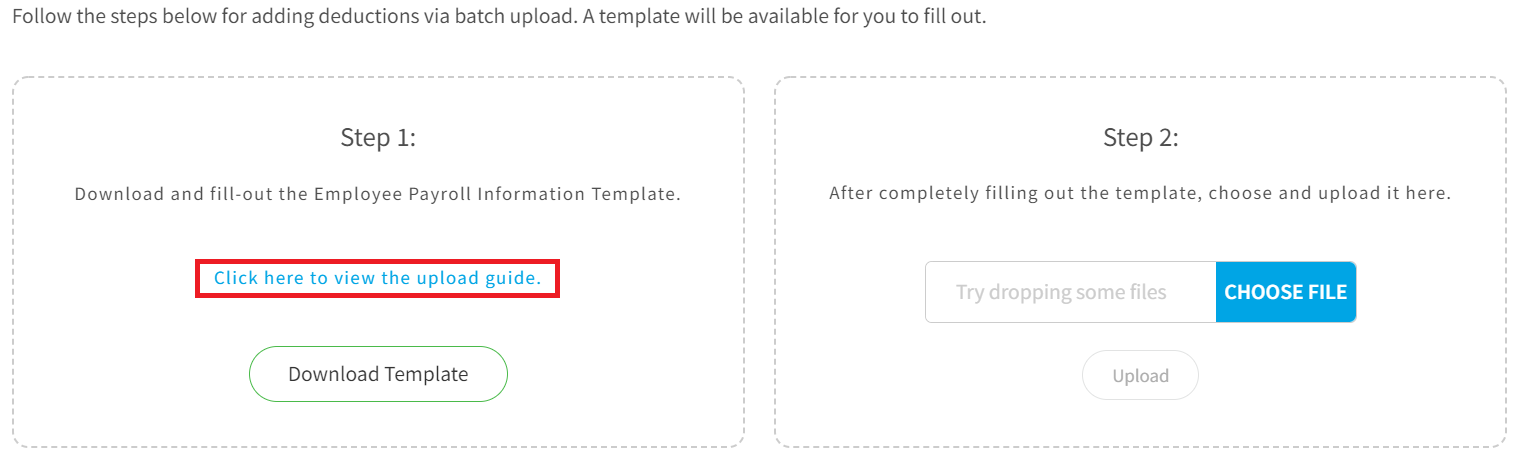

4. Click Download Template.

- The CSV file template will automatically be downloaded on your computer.

5. Open the file and accomplish the template. You may click on the upload guide link found above the Download Template button.

6. After accomplishing the template with the deduction details, under Step 2, click on the Choose File button.

7. Attach the updated template and click Upload to proceed to data validation.

- Once validated, the deduction record is displayed in the Deductions list.

Related Articles

View and Edit Deduction

View Deductions To View Deductions: 1. From the Top Navigation Bar, head to Employees > Deductions. Deduction List is displayed. From this list, you can already view each employee’s deduction details: Employee Name Deduction Type Date Created Amount ...Download/Delete Deduction

Download Deduction To download Deductions: 1. From the Top Navigation Bar, head to Employees > Deductions. 2. From the Deductions List, tick the checkbox across the item to be downloaded. Multiple items can be downloaded all at once by ticking the ...Add Loans

Add Loans - Manual Entry To Add a Loan via Manual Entry: 1. From the Top Navigation Bar, head to Employees > Loans. 2. Click on the Add Loans button. 3. Choose the Manual Entry option. 4. Enter the necessary initial information: Employee name or ...Add Allowances

Add Allowances To Add an Allowance (Manual Entry): 1. From the Top Navigation Bar, head to Employees > Allowances. 2. Click on the Add Allowances button. 3. Choose the Manual Entry option. 4. Enter the necessary initial information: Employee name or ...Add Employee Termination Details and Final Pay Computation

Proper termination process is followed when an employee is about to leave the company due to either of the following reasons: Resignation Termination Retirement Employee termination details must be updated in preparation for the computation of the ...